Tax Return:: 2021 NEW! LITO (Low Income Tax Offset)

Hello everyone, this is P&C Tax Professionals.

Today in this post I am going to fill you in on the Low Income Tax Offset (LITO) that has been recently updated for the 2021 Financial Year.

First of all, the LMITO (Low and Middle Income Tax Offsets) which had previously being introduced, allowed individuals who had an income of more than $12,185 but less than $125,333 to claim for the full benefits of the tax credits.

The tax offset corresponding to each of the income bracket are presented below:

The LMITO rates that applies to each of the income brackets remains the same as last year.

However, there is a change in the LITO rates which would be effective from the 2020-2021 financial year.

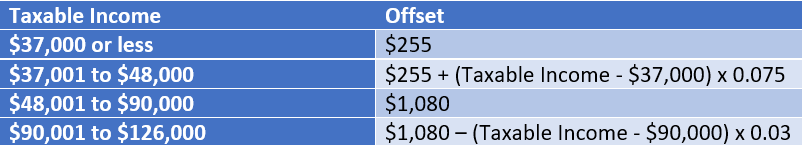

The existing LITO table pre-2021:

The updated LITO table for the 2020-2021 financial year:

In summary, the maximum low income tax offset amount you can claim for has gone up from $445 to $700 which I assume is great news!

Below are several examples to help you understand your LITO calculations:

1. If your taxable income is $37,500 or less

Offset amount you are entitled to = $700

2. If your taxable income is between $37,501 to $45,000

Offset amount you are entitled to = $700 - (Taxable Income - $37,500) x 0.05

E.g. If your taxable income sums up to $40,000, Offset amount = $700 - ($40,000 - $37,500) x 0.05 = $575

3. If your taxable income is between $45,001 to $$66,667

Offset amount you are entitled to = $325 - (Taxable Income - $45,000) x 0.015

E.g. If your taxable income sums up to $60,000, Offset amount = $325 - ($60,000 - $45,000) x 0.015 = $100

4. If your taxable income is $66,668 and above

Offset amount you are entitled to = $0

Individuals who are deemed as an Australian resident for tax purposes and who pays tax on their taxable income may be eligible for one or both of the two tax offsets mentioned above (LMITO and/or LITO) depending on their taxable income for the financial year.

If you apply for your tax return through P&C Tax, both of these tax offsets will automatically be calculated and processed for you.

If you happen to have any further enquiries regarding tax returns in Australia, please feel free to contact us through our official Facebook page (P&C Tax Professionals - Australia) or via our email address: pnctax@naver.com at your convenience.

Comments